Domestic Gold Price Influencers

Inflation

Gold has also long been considered an inflation hedge because high inflation decreases the dollar’s value, causing the cost of gold — valued in dollars — to rise. Throughout 2023, inflation proved to be stubborn. While it dropped from 6.4% in January, to 3.7% in Q4, it remained well above the Fed’s target rate of 2%. U.S. consumers continue to feel the weight of high prices particularly for gasoline, groceries, and housing. The IMF has warned of stubborn inflation and weak global growth ahead in 2024 and is urging central banks to keep monetary policy tight. 1

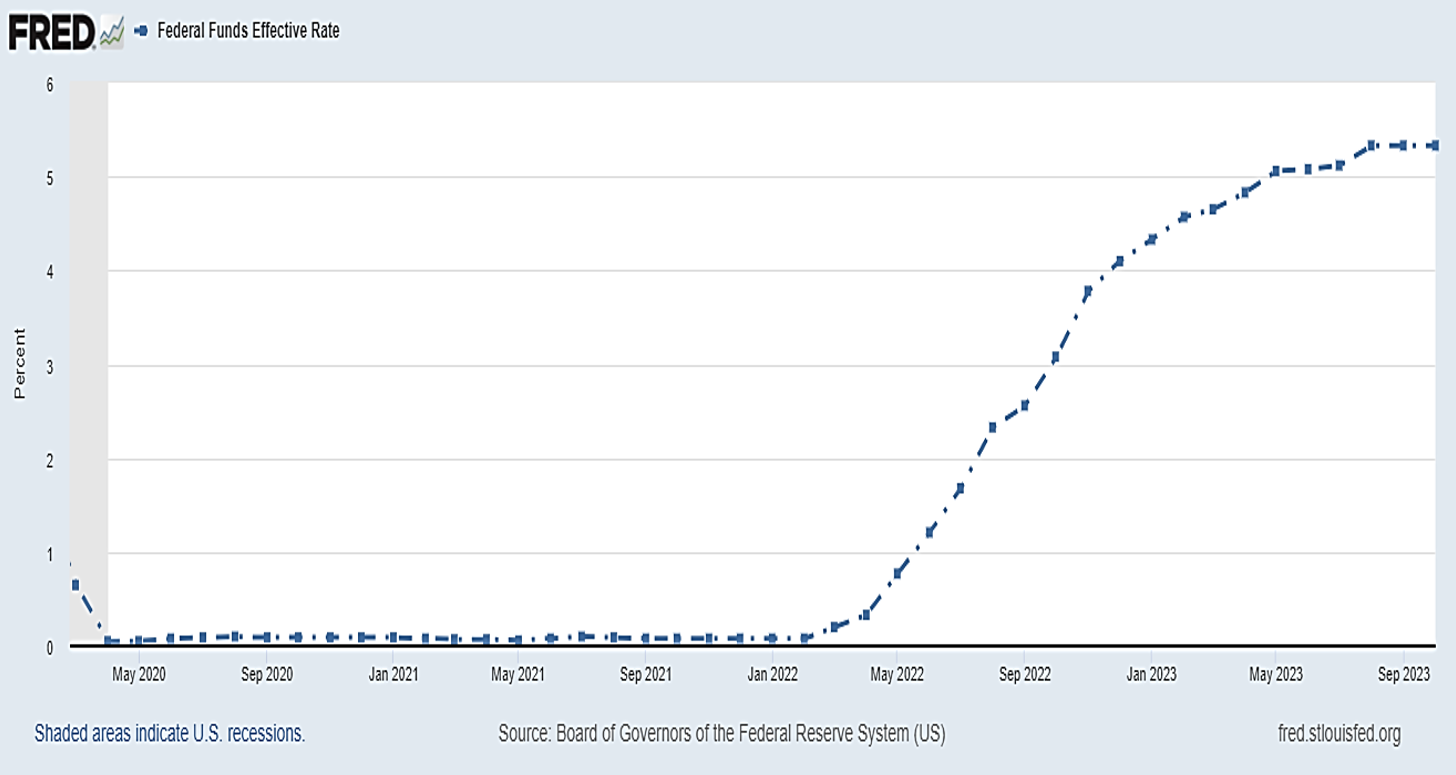

Interest Rates

While gold typically drops in a high-interest rate environment, it defied that rule in 2023. According to Yahoo Finance, high-interest rates typically mean that investors “can earn an attractive return by putting their money in US Treasuries rather than gold. 2 But as interest rates rose fastest in forty years, gold still climbed almost 8%. With most experts expecting the Fed to cut rates in 2024, gold could breakout even higher. A November Reuters report stated that gold prices will rise in 2024 on bets that global central banks will start monetary policy easing in light of the Middle East conflict triggering a safe-haven rally that will push gold above $2,000.” 3

Another critical consequence of the dramatic rise in interest rates is what’s called the “Lock-In Effect” which has turned the U.S. housing market upside down. The Lock-In Effect makes homeowners reluctant, unwilling, or unable to sell their homes because they “locked in” ultra-low pandemic era mortgage rates. This has suppressed available inventory, driven home prices higher and according to Bloomberg, resulted in “the least affordable housing market since the 1980s, with sales approaching record lows.” 4

Federal Funds Rate from May 2020 to September 2023

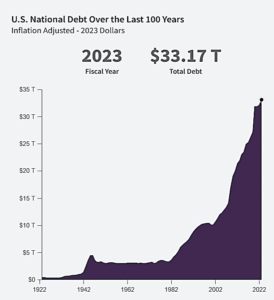

Federal Spending & Debt

America’s national debt has eclipsed $33 trillion for the first time ever. It’s a troubling, new milestone and one that reflects America excessive borrowing and chronic revenue shortfalls.

The U.S. Treasury Department explains our national debt as follows:

“The national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time. In a given fiscal year, when spending exceeds revenue, a budget deficit results. To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities. The national debt is the accumulation of this borrowing along with associated interest owed to the investors who purchased these securities.” 5

Rising federal debt can undercut economic growth, result in the sale of more and more government bonds, force interest rates higher, push stock returns lower, and create a staggering loss of confidence in the U.S dollar. The pace of debt accumulation and the sheer size of America’s potential default is commonly referred to as the “debt bomb.” According to the Heritage Foundation, we are currently on track to borrow as much in the next six months as in the previous twelve and the time to change course — has all but run out.

The pace of debt accumulation and the sheer size of America’s potential default is commonly referred to as the “debt bomb.” According to the Heritage Foundation, we are currently on track to borrow as much in the next six months as in the previous twelve and the time to change course — has all but run out.

“This is now a vicious cycle wherein the Biden administration and its allies in Congress continue to spend too much money, growing the deficit and debt, and further depleting confidence in Treasuries. That drives up yields and therefore the cost of servicing the debt, which makes the deficit grow even faster, which means more debt, and so on. The Treasury’s latest admission of how fast the deficit is increasing tells America that the fuse on this bomb is nowhere near as long as we thought it was.” 6

There is a high correlation between the price of gold and America’s amassed federal debt. One gold mutual fund places that correlation as high as 92%.

“Gold priced in U.S. dollars has a 92% correlation to Total Federal Debt Outstanding since Nixon closed the Gold Window in 1971. It is clear to us that the mark down of the dollar versus gold over the last 50 years is tied to the deterioration of the U.S. balance sheet and lack of fiscal discipline in Washington. In 2023, rising interest expenditures are only adding to the rapid rise in Total Federal Debt Outstanding. The U.S. budget deficit over the last four months is 4 times greater than 2022 at $701 billion as lower tax revenues along with higher interest expenses take its toll.” 7

Gold has always been considered a safe haven and a stable asset in the face fiscal deterioration and a potential economic default.

- https://www.bloomberg.com/news/articles/2023-10-10/imf-warns-of-inflation-s-tenacity-weaker-global-growth-in-2024 ↩︎

- https://finance.yahoo.com/news/gold-stays-above-2000-despite-stable-dollar-higher-rates-180212755.html ↩︎

- https://www.reuters.com/markets/commodities/gold-supported-2024-by-bets-monetary-policy-easing-mid-east-war-risks-2023-11-01/ ↩︎

- https://www.bloomberg.com/news/articles/2023-11-02/housing-crisis-gets-worse-for-americans-on-mortgage-lock-in-effect?srnd=premium ↩︎

- https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/ ↩︎

- https://www.heritage.org/debt/commentary/the-fuse-americas-debt-bomb-just-got-shorter ↩︎

- https://ocmgoldfund.com/ocm-perspective-gold-and-debt-correlation/ ↩︎