Last week, Treasury Secretary Janet Yellen testified at the Senate Finance Committee hearing in Washington that President Biden does not have a plan on Social Security solvency. In his typical ‘tax and spend’ posturing, Biden looks to make up virtually all federal “shortfalls” by increasing taxes on the wages, investment gains, and self-employment income of those making over $400,000 a year.

Senator Bill Cassidy, R-La asked Yellen what the tax rate would have to be to address “the unfunded accrued liability for Social Security.” Yellen replied, “I don’t have that computation to offer you,” before saying, “The president doesn’t have a plan. He has principles.”

Biden Has “Principles” but no plan for Social Security solvency? Will “PRINCIPLES” fund your RETIREMENT?

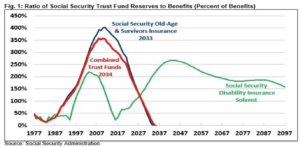

Social Security is the largest part of the federal budget and projections last year estimated that the retirement fund could run out of money as soon as 2033. Social Security is, of course, financed through payroll taxes.

In Biden’s proposed $7.3 trillion budget for fiscal year 2025, he wants to increase the discretionary budget for social security by $1.3 billion from 2023, bringing the total agency budget to $15.4 billion. But according to Yahoo Finance, that amount DOES NOT include funding benefits. “The president’s budget proposal relates only to SSA’s administrative functions.” So, he wants to “improve service” for an agency that may not be able to pay full benefits to the millions of Americans that are counting on that money.

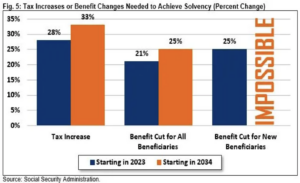

According to the Committee for a Responsible Federal Government 2023 Social Security Analysis, “upon insolvency, all retirees regardless of age, income, or need will face a 20 percent across-the-board benefit cut, which will grow to 26 percent by the end of the 75-year projection window.”

According to the Committee for a Responsible Federal Government 2023 Social Security Analysis, “upon insolvency, all retirees regardless of age, income, or need will face a 20 percent across-the-board benefit cut, which will grow to 26 percent by the end of the 75-year projection window.”

Shortfalls. Insolvency. Reduced Benefits? How did we get here?

Marcum, one of the nation’s leading accounting and advisory firms, says that while Social Security may not be going bankrupt, it does have a serious math problem. According to the firm, the Social Security Trust Fund is dwindling because baby boomers are retiring in heavy numbers, putting greater demand on the system. Americans are also living longer, and longer life expectancy means longer benefit payouts. And since U.S. birthrates have been steadily declining (down 20% since 2007) there are fewer workers paying into the system.

And the funding shortfall is only going to get worse. According to the 2022 OASDI (Old-Age, Survivors, and Disability Insurance) Trustees Report, the ratio of workers paying Social Security taxes per beneficiary — is projected to decline from 2.8 in 2021 to just 2.3 by 2035.

Retirees face tax increases and big benefit cuts — and the closer Social Security gets to insolvency, the harder the choices become.

As the Biden administration focuses on administrative improvements to social security, Americans who paid into the Trust Fund their entire working lives are facing an uncertain retirement.

As the Biden administration focuses on administrative improvements to social security, Americans who paid into the Trust Fund their entire working lives are facing an uncertain retirement.

When Senator Cassidy asked Secretary Yellen how President Biden could “justify not having a plan” for Social Security “when he’s been in office for three years already,” said the president “believes it’s important to work with Congress.” But Cassidy argued that he and other members on the Senate Finance Committee have not heard “one peep” from the president on the matter.

READER WARNING – If you’re counting on the President, the government, or Congress to “Save” Social Security, consider the math and then consider an alternative with a track record of retirement protection.

Take control of your financial future with a self-directed IRA invested in precious metals from Priority Gold – America’s Precious Metals Dealer.

Speak to a LIVE Priority Gold representative at: 888-506-6439