The Rising Price of Hamburgers, Cars, and Gold!

Stubborn inflation, rate cut hopes, Central Bank buying, and global risk push gold to new records.

Gold extended its gains early Tuesday ahead of the core personal consumption expenditures index due out Friday, March 29th. Expectations, according to Yahoo Finance is for inflation to remain “uncomfortably high,” potentially undermining the Fed’s planned three rate cuts for this year. Gold has a fairly solid reputation as an inflation hedge. According to Forbes contributor John Dorfman, “the theory is that the yellow metal tends to hold a fairly constant purchasing power. If the price of hamburgers and cars goes up, so will the price of an ounce of gold.”

Inflation and the prospect of multiple interest rate cuts have been driving gold for the better part of 2024. According to Reuters, a low-interest rate environment reduces the opportunity cost of holding “non-yielding” gold and weighs on the dollar which makes the precious metal cheaper for foreign buyers.

Central Banks Go All-In for Gold

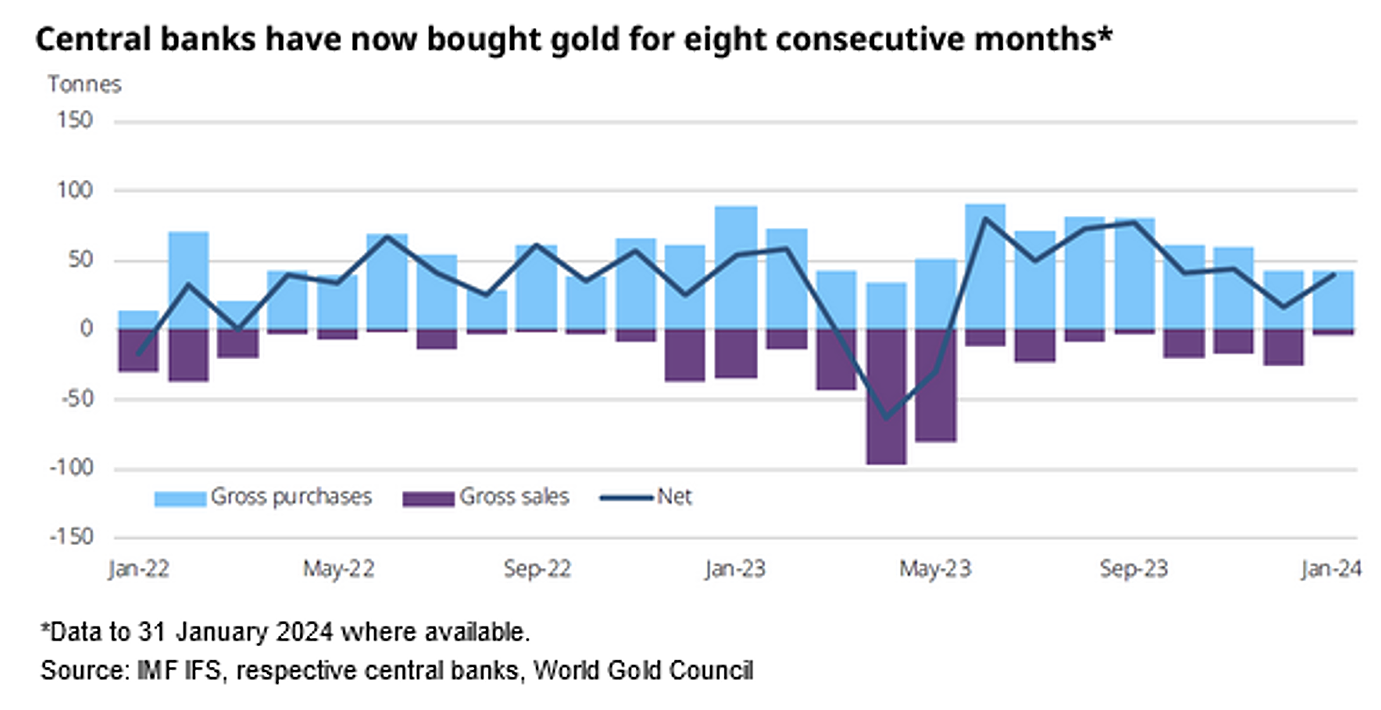

The price of gold is also being propelled by record-setting central bank buying in an effort to diversify away from the dollar. The World Gold Council, described the central bank gold run in 2023 as “colossal” with China, Poland and Uzbekistan leading the way. The People’s Bank of China added 225 tonnes to its gold reserves last year, the country’s highest addition since 1977. In January of 2024, the World Gold Council reported that central banks added another 39 tonnes to their reserves capping off eight consecutive months of robust gold buying by the world’s leading monetary authorities supporting strong demand into 2024. Key buyers in January again included China as well as Turkey, India, Kazakhstan, Jordan, and Czechoslovakia.

The price of gold is also being propelled by record-setting central bank buying in an effort to diversify away from the dollar. The World Gold Council, described the central bank gold run in 2023 as “colossal” with China, Poland and Uzbekistan leading the way. The People’s Bank of China added 225 tonnes to its gold reserves last year, the country’s highest addition since 1977. In January of 2024, the World Gold Council reported that central banks added another 39 tonnes to their reserves capping off eight consecutive months of robust gold buying by the world’s leading monetary authorities supporting strong demand into 2024. Key buyers in January again included China as well as Turkey, India, Kazakhstan, Jordan, and Czechoslovakia.

A Deteriorating Global Outlook and Historic World Elections

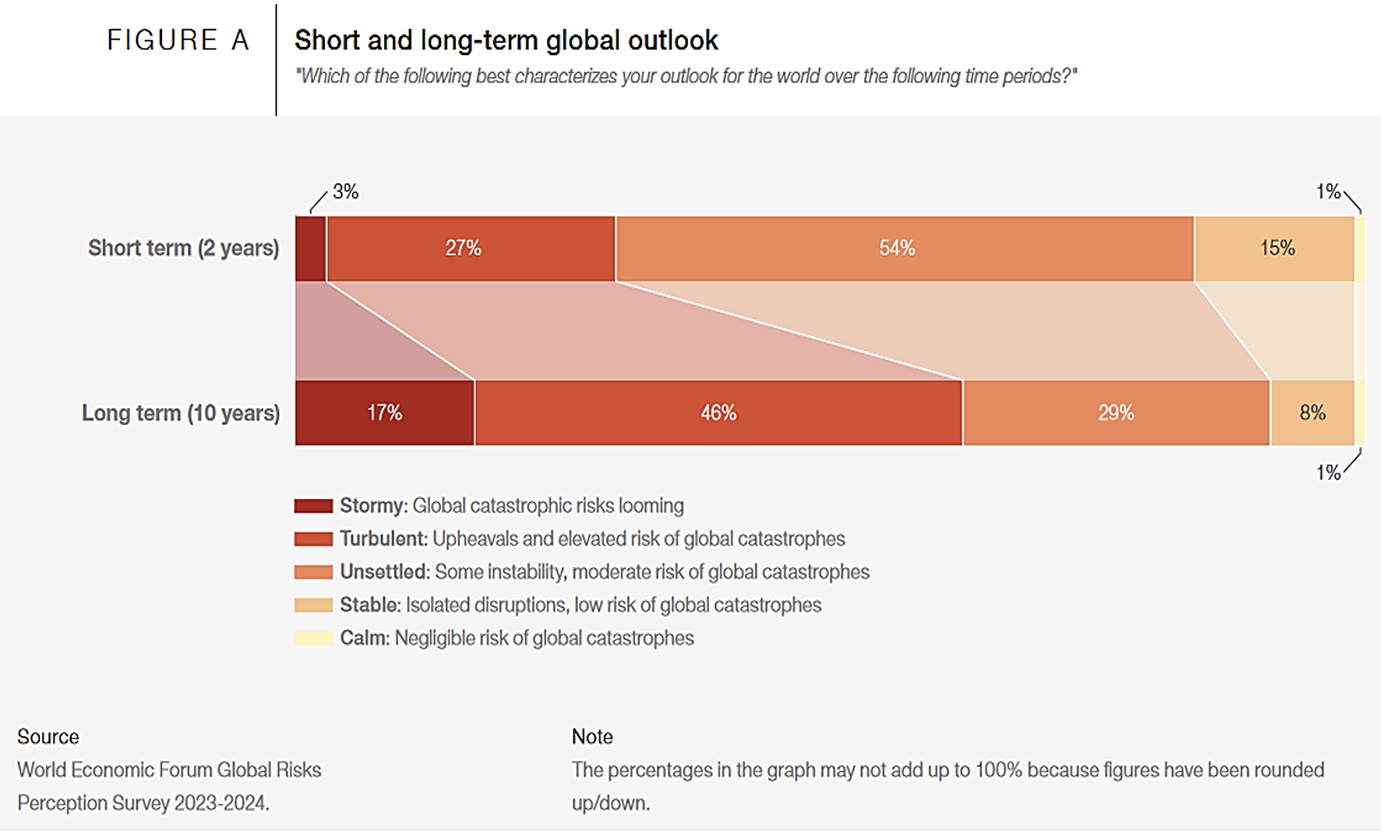

Gold also thrives amid rising geopolitical uncertainty and risk — namely the war between Russia and Ukraine and the ongoing fighting between Israel and Hamas. The World Economic Forum’s Global Risk Report for 2024 paints a “deteriorating global outlook.” Specifically, the report states: “As we enter 2024, 2023-2024 GRPS results highlight a predominantly negative outlook for the world over the next two years that is expected to worsen over the next decade.”

According to Barron’s, geopolitical uncertainty drives gold demand, and it will have a profound impact on gold buying in 2024 due to global conflicts, trade tension, and the more than 60 elections taking place around the world.

Indeed, more voters than ever in world history will head to the polls this year, representing almost half of the world’s population. And the outcome of these elections will have profound impact on the global economy, world markets, business cycles, and even economic growth.

The 2024 U.S. Election is a Highly “Market-Relevant” Event

Goldman Sachs is predicting that 2024’s “record share of elections will ripple through the world’s economy” and increase economic uncertainty. They see this year’s U.S. presidential as a particularly “market-relevant event, as the macro impacts of the election regarding several key policy issues could have more significant impacts on rates and (currency) markets.”

A “Trifecta of Momentum” for Gold

Gold continues to reach record highs and the pivotal forces driving it support steady and persistent demand. Saxo Bank’s Ole Hasen recently told Reuters, “Following on from a surprisingly robust performance in 2023 we see further price gains in 2024, driven by a trifecta of momentum chasing hedge funds, central banks continuing to buy physical gold at a firm pace, and not least renewed demand from ETF investors.”

GOLD is CLIMBING in a perfect storm of global forces! Capitalize on rising demand and record-setting prices!

Reach out to Priority Gold – ‘America’s Precious Metals Dealer’ for Gold, Silver, or a Precious Metals IRA.

Priority Gold is endorsed by American Commentator, Author and TV and Radio Host Lou Dobbs and renowned Economist, Financial News Personality, and former White House economic advisor, Larry Kudlow.

Speak to a LIVE Priority Gold representative at: 888-506-6439