What Exactly is Inflation?

With the latest U.S. inflation report (Consumer Price Index) coming in “hot,” higher than expected, and stubbornly high — it’s a good time to revisit the actual definition of inflation.

According to the International Monetary Fund, “inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year.” 1 The U.S. Bureau of Labor Statistics further defines inflation as “the overall general upward price movement of goods and services in an economy.”2

U.S. consumers don’t need a monthly report to tell them that everything costs more. They’re feeling it in their day-to-day spending habits — and it’s creating stress, tension, and in many cases financial hardship.

The impact of inflation is evident everywhere from the price of eggs, to a gallon of gas, to the cost of clothing, home repairs, vacations, even fast food. According to Rocket Money, rising inflation is downright pervasive:

“The effects of inflation are easy to see – and feel. You’ve likely seen evidence of it in supermarket aisles or at car dealerships. From health care to energy prices – and everything in between – inflation is making daily life a little more expensive for everyone.”3

The financial burden of rising inflation, however, is far more serious than an attack of sticker shock or grocery store gloom. Unchecked inflation has serious adverse economic consequences that are bad for U.S. consumers and dangerous for American prosperity.

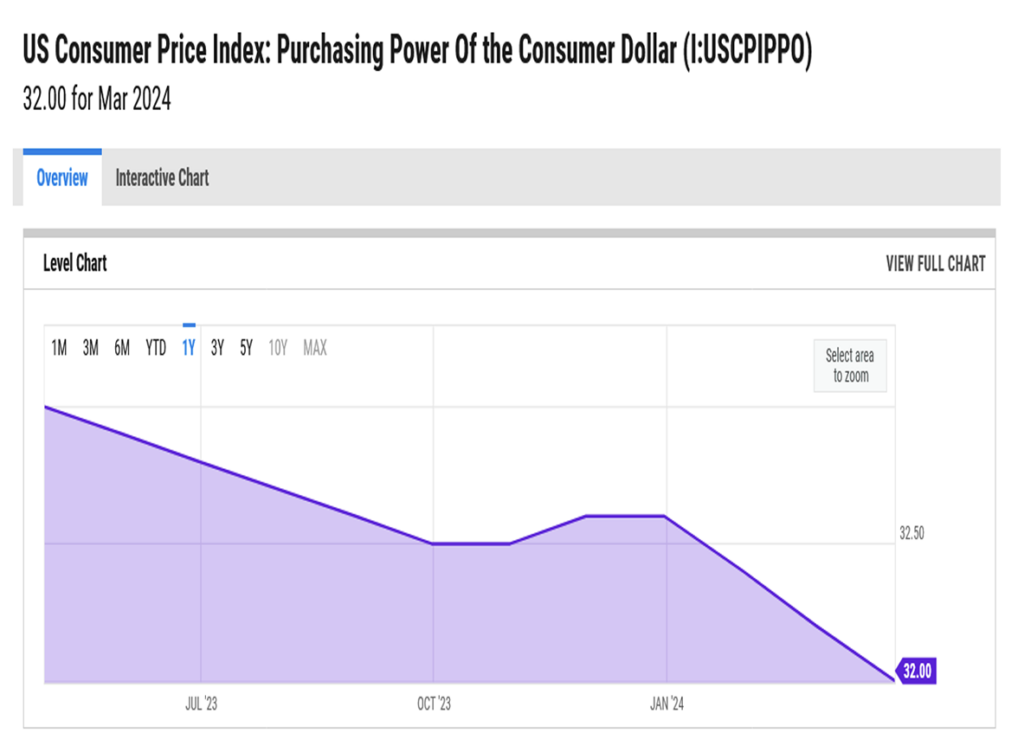

Inflation Erodes Purchasing Power

One of the more punishing impacts of inflation is that it erodes purchasing power. This is a fancy way of saying that your money buys less or simply doesn’t go as far. Forbes provides the following illustration:

“In 1980, for example, a movie ticket cost on average $2.89. By 2019, the average price of a movie ticket had risen to $9.16. If you saved a $10 bill from 1980, it would buy two fewer movie tickets in 2019 than it would have nearly four decades earlier.”4

Indeed, the buying power of the U.S. dollar has collapsed, particularly over the last twenty years5 with some claims that the greenback has lost as much as 98% of its purchasing power since 1971, the year it was delinked from the gold standard.

To better understand the pronounced impact of inflation, enter some valuations into the American Institute for Economic Research’s Cost of Living Calculator. If you do a comparison of $100 on the year you were born versus the current year — you’ll get a snapshot of dollar inflation in your lifetime.

The dollar’s eroding purchasing power impacts consumer incomes, household budgets, how much folks can save, invest, or put away into a nest egg. And since the dollar is worth less in an inflationary environment, investments valued in dollars are also diminishing. So, high inflation not only undermines the American economy, it also undercuts the American dream.

High Prices Crush Economic Growth

Plainly stated, inflation is an economy-killer. During periods of high inflation, the Fed tends to tighten monetary policy which makes credit more expensive and loans costlier. This not only impacts consumer spending and debt levels but reduces business investment. A recent report by McKinsey & Company described high inflation’s impact on manufacturing:

“Companies lose purchasing power, and risk seeing their margins decline, when prices increase for inputs used in production, such as raw materials like coal and crude oil, intermediate products such as flour and steel, and finished machinery. In response, companies typically raise the prices of their products or services to offset inflation, meaning consumers absorb these price increases.”6

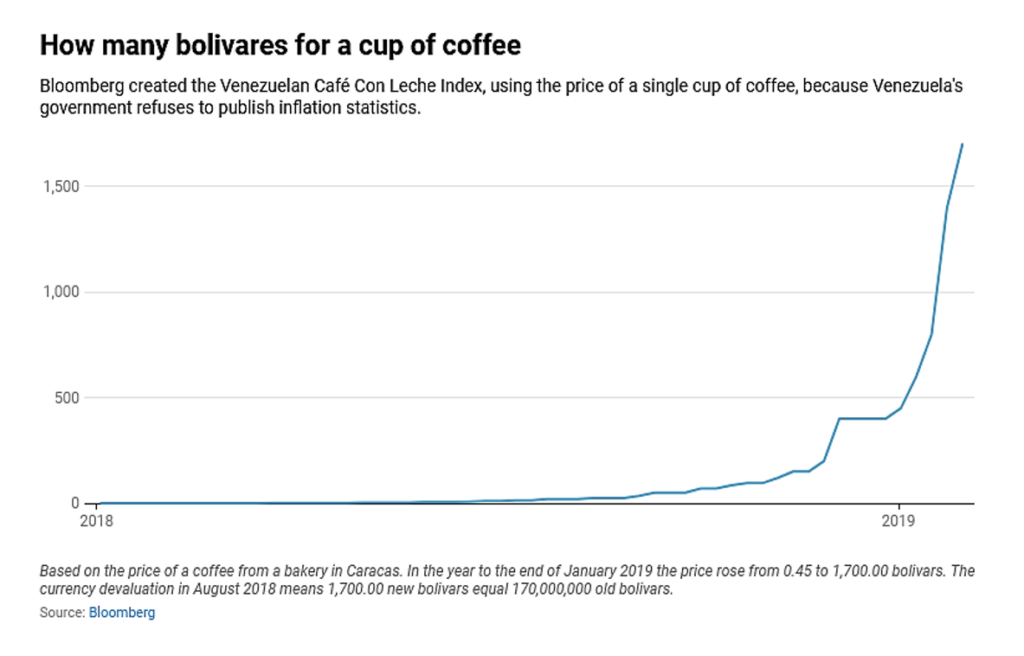

When high prices are passed on to consumers, they typically buy fewer goods and spend less on services effectively slowing the economy. Unchecked inflation, according to Forbes “can topple a country’s economy, like in 2018 when Venezuela’s inflation rate hit over 1,000,000% a month, causing the economy to collapse and forcing countless citizens to flee the country.”7 Bloomberg reported that Venezuela’s currency became so devalued against the dollar (losing more than 99%), that it actually broke the stock market.8

When high prices are passed on to consumers, they typically buy fewer goods and spend less on services effectively slowing the economy. Unchecked inflation, according to Forbes “can topple a country’s economy, like in 2018 when Venezuela’s inflation rate hit over 1,000,000% a month, causing the economy to collapse and forcing countless citizens to flee the country.”7 Bloomberg reported that Venezuela’s currency became so devalued against the dollar (losing more than 99%), that it actually broke the stock market.8

Why Gold is Considered an Inflation Hedge

Fiat currencies have failed throughout history mainly due to inflation and hyperinflation including the German papiermark, the Yugoslav dinar, and the Zimbabwean dollar — gold, however, has served as a critical safe haven. It’s considered an ‘inflation hedge’ due to its intrinsic value, inherently limited supply, and rising demand when currencies tumble. And gold has something else … permanence.

“Gold has proved, over hundreds and even thousands of years, to be a reliable store of value,” says Fergus Hodgson, director of Econ Americas, a financial consulting firm. “In other words, whatever events happen, gold has a robust value that stays relatively consistent over time in terms of its purchasing power.”9

As an ideal inflation hedge, gold not only helps offset a decline in the purchasing power of currency, it’s a durable store of value. So, as inflation becomes more and more worrisome for consumers, retirees, and savers — gold can provide critical peace of mind.

A FEW WORDS ABOUT INFLATION …

“Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once unthinkable dosages will almost certainly bring on unwelcome after-effects. Their precise nature is anyone’s guess, though one likely consequence is an onslaught of inflation.”

– Warren Buffett, American Businessman, Investor, and CEO of Berkshire Hathaway

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

– Ernest Hemingway, American Novelist

“Inflation is taxation without legislation.”

– Milton Friedman, American Economist and Statistician

1 INFLATION: PRICES ON THE RISE

2 Overview of BLS Statistics on Inflation and Prices

3 The Effects Of Inflation: What You Need To Know

4 How Inflation Erodes The Value Of Your Money

5 US Consumer Price Index: Purchasing Power Of the Consumer Dollar

6 What is inflation?

7 How Inflation Erodes The Value Of Your Money

8 Venezuela’s Inflation Is So Extreme It’s Broken the Stock Market

9 How to Invest in Gold as an Inflation Hedge