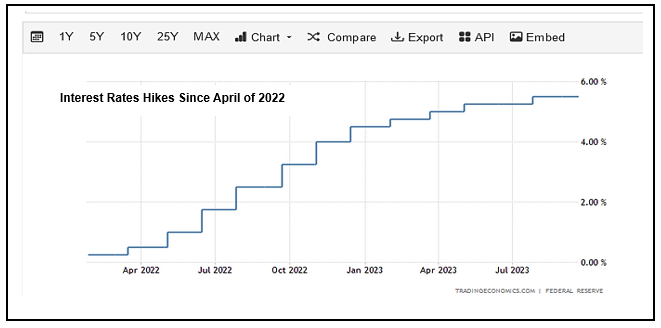

The Fed has turned hawkish, very hawkish. A hawkish Fed favors high interest rates and tight monetary policy to control inflation. The current Federal Reserve regime has raised interest rates a staggering 11 times in just 16 months to tame the soaring prices plaguing U.S. consumers.

The current federal funds target rate is at 5.25%-5.50%. It was essentially zero as recently as the first quarter of last year before rates were increased at the fastest pace in 40 years.

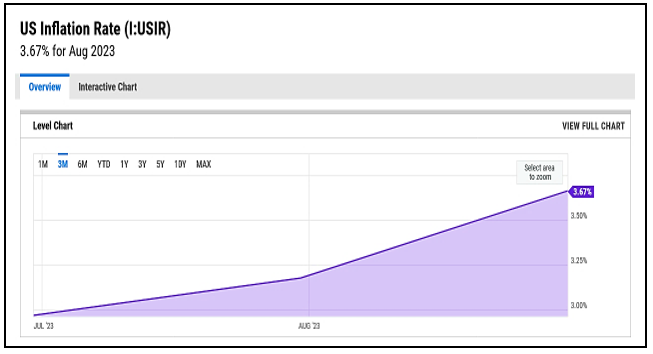

So, has inflation come down? The current U.S. inflation rate is 3.67%, down from over 9% last summer but also short of the Fed’s 2% goal. And despite the aggressive rate measures, it has now started to climb back up. It was under 3% in June and data indicates it rose in both July and August due to spikes in food, energy, and gas prices. And the August uptick rose at a faster pace than in July.

So, Americans continue to feel the pain of high prices particularly for meat, poultry, dairy products, clothing, and personal care items — as well as for rent, housing, and prescription drugs.

The Consumer Confidence Survey fell in September for the second straight month due to consumer angst over the price of ‘groceries and gas’ as well as rising interest rates.

The prospect of ‘higher for longer’ rates also impacts Americans looking to buy a new home or car. According to a recent Wall Street Journal report, a typical U.S. household would need 42 weeks of income to buy a new car as of August — up from 33 weeks three years ago and the typical family simply cannot afford a median-priced home, which according to CBS news has now hit $407,100 which is out of reach for 99% of average income earners in America.

And when the Fed raises it target rate, the APR on credit cards also rises making it more expensive to carry balances and more difficult to pay down — adding more stress to already stretched consumers. During the second quarter of this year, U.S. credit card debt hit a record $1 trillion, fueling overall household debt which has now risen $2.9 trillion since the end of 2019.

Wall Street is also not a fan of higher rates. According to Investopedia, interest rates and the stock market have an inverse relationship. When rates rise, share prices fall and bonds become more attractive. Simply stated, higher rates make corporate borrowing more expensive, leaving less money to put back into business for expansion — which stifles growth, jeopardizes future earnings, and puts pressure on share prices.

Higher rates can also hurt small businesses by limiting their ability to borrow, finance, and pay down existing debt. According to The Wall Street Journal many companies borrowed at ultralow, short-term rates during the pandemic and are now struggling with loan payments that have risen dramatically as rates have spiked. Riskier corporate borrowers, in particular, who gained funding through more costly leveraged loans — about $270 billion worth — are now teetering on default. With estimated interest costs hovering near $1.7 trillion, the default rate for the past 12 months has risen to the highest level since 2014.

So, while the Fed has aggressively raised rates to curb soaring prices, it has also dramatically increased the cost of borrowing, buying, financing, and servicing existing debt impacting both consumers and businesses. Higher rates reduce the demand for goods, services and investment on Main Street and Wall Street slowing consumer spending, sinking stock prices, and weakening economic growth.

Perhaps this is why gold, silver and other precious metals are of increasing interest to consumers in the current economy. As alternative assets, they tend to behave differently than stocks, bonds, and paper currencies. Gold has a long track record as a monetary standard and is considered a valuable diversifier and a time-tested store of value

So, with interest rates on a “higher for longer” path — holding a percentage of physical gold in a financial or retirement portfolio makes sense and America’s Precious Metals Dealer, Priority Gold, can get you started. They understand the current risks to the economy and how gold can help mitigate them. An advisor is standing by at 1-888-219-2099 and more information is available at www.PriorityGold.com.

“The folks at Priority Gold understand the very real threat to the U.S. economy from inflation, soaring interest rates, rising energy prices, the border crisis, and the utter failure of Bidenomics.”

Larry Kudlow, Business News Anchor and Former White House Economic Advisor

Priority Gold is among the most trusted precious metals dealers in the U.S. with a Better Business Bureau Rating of A+, a AAA Rating with the Business-Consumer Alliance, and a 5 Star Rating with Trustlink. And the Priority Gold ‘Buy Back’ and ‘Price Protection Plan’ help ensure transactional integrity, the highest standard of professional conduct, and complete customer satisfaction.