Gold price reaches 6-year high

KEY POINTS

- Investors plow into the precious metal amid the prospects for lower interest rates, a softer global economy and increased geopolitical tensions.

- Futures for August delivery hit a high of $1,442.90 per ounce overnight, its highest level since May 14, 2013, when it reached $1,444.90.

Gold prices hit their highest level in six years on Tuesday as investors plowed into the precious metal amid the prospects for lower interest rates, a softer global economy and increased geopolitical tensions.

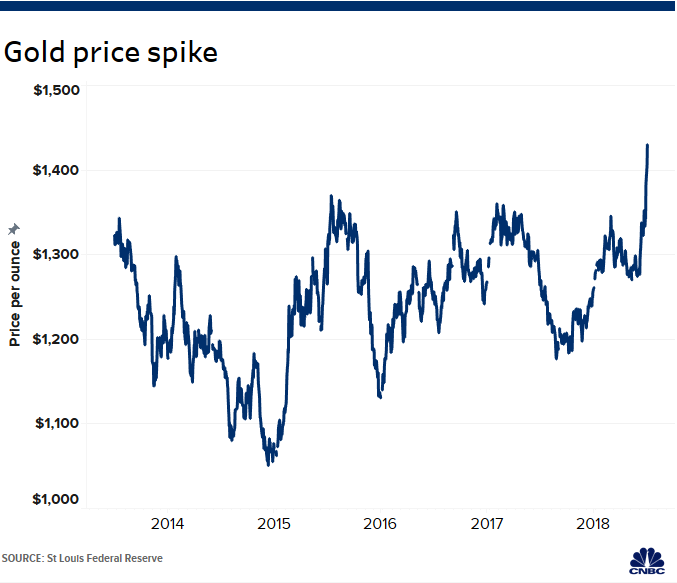

Futures for August delivery hit a high of $1,442.90 per ounce overnight, its highest level since May 14, 2013, when it reached $1,444.90. As of 9:48 a.m. ET, gold traded 1.2% higher at $1,435.60.

Gold has been on a tear, rallying more than 8% this month and over 9% for the quarter. Those gains put the metal on pace for its best monthly and quarterly performances since 2016.

In that time, expectations for the Federal Reserve to cut interest rates have increased sharply. Traders are currently pricing in a 100% probability of a rate cut in July, according to the CME Group’s FedWatch tool.

The Fed said last week it will “act as appropriate” to maintain the current economic expansion. The announcement sent rates along with the U.S. dollar lower. Gold is seen as store of value in times of a weakening dollar and economic activity.

“The decision by the Fed to leave rates unchanged was the consensus expectation among economic forecasters, but an outside chance of an early ‘insurance’ cut was reflected in the interest rate market ahead of the meeting,” James Steel, chief precious metals analyst at HSBC, wrote in a note. “While this should support gold, we wonder how much further gold can rally as much of what the Fed said is already in the price we believe. Also the USD looks firm longer term.”

The central bank’s remarks came after the release of softer economic data. The Philadelphia Fed’s manufacturing index tumbled to its lowest level since February, and jobs creation slowed down to just 75,000 last month.

Investors also added to their gold holdings amid rising tensions between the U.S. and Iran. President Donald Trump signed an executive order on Monday to impose “hard-hitting” sanctions after a U.S. drone was shot down last week. The U.S. says the drone was flying in international airspace, but Iran says the drone was flying over Iran, violating international law.

Source: CNBC